Table of Contents

- Our Story - VGT

- vgt — Postimages

- Teori dan Cara kerja VGT (Variable Geometry Turbocharger) - mautaumobil.com

- Wat is VGT? / Theoretische achtergrond | NT2 voor doven

- Araçlarda VGT Nedir? Ne İşe Yarar? Avantajları Nelerdir? - Smart Hode

- The Ferrari VGT is actually stunning ! : r/granturismo

- VGT 🟥 - YouTube

- /vgt/ - Rigged Wiki

- Contact – VGT

- [GT7] 제네시스 VGT_도쿄 익스프레스웨이 - YouTube

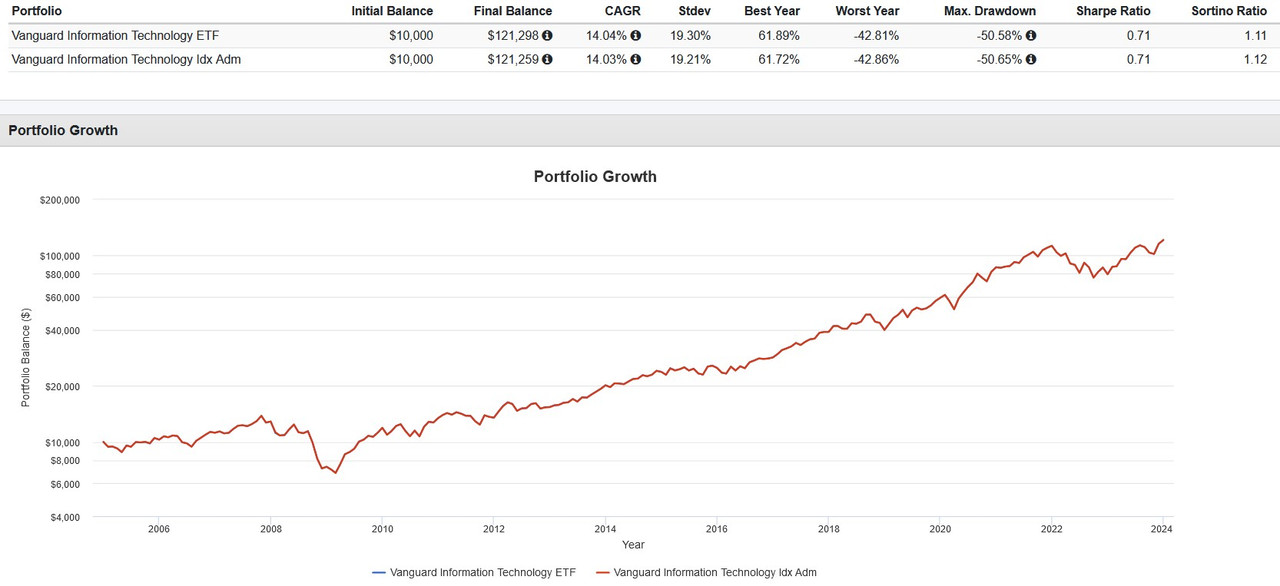

What is the VGT-Vanguard Information Technology ETF?

Benefits of Investing in the VGT-Vanguard Information Technology ETF

![[GT7] 제네시스 VGT_도쿄 익스프레스웨이 - YouTube](https://i.ytimg.com/vi/zgYymxdXNJY/maxresdefault.jpg)

Top Holdings

The VGT-Vanguard Information Technology ETF has a diverse portfolio of technology stocks, with the top holdings including: Apple Inc. (AAPL) Microsoft Corporation (MSFT) Alphabet Inc. (GOOGL) Amazon.com Inc. (AMZN) Facebook Inc. (FB)

Risks and Considerations

While the VGT-Vanguard Information Technology ETF offers many benefits, there are also risks and considerations to be aware of, including: Market Volatility: The technology sector can be highly volatile, with stock prices fluctuating rapidly in response to news and events. Concentration Risk: The ETF is heavily weighted towards large-cap technology companies, which can increase concentration risk. Regulatory Risks: Changes in government regulations and policies can impact the technology sector and the ETF's performance. The VGT-Vanguard Information Technology ETF is a popular and cost-effective way to gain exposure to the US technology sector. With its diversified portfolio and low costs, it's an attractive option for investors looking to tap into the growth potential of the technology industry. However, as with any investment, it's essential to be aware of the risks and considerations, including market volatility, concentration risk, and regulatory risks. By doing your research and understanding the benefits and risks, you can make an informed decision about whether the VGT-Vanguard Information Technology ETF is right for your investment portfolio.Investing in the VGT-Vanguard Information Technology ETF can provide a solid foundation for long-term growth and diversification. With its strong track record and low costs, it's an excellent choice for investors looking to capitalize on the growth potential of the technology sector.