Table of Contents

- Social Security's 2025 COLA Is Now a Reality. Here's How Much it ...

- Social Security 2025 COLA Below 20-Year Average — Is It Enough?

- Social Security 2025 COLA estimates: What to know about increase | wfaa.com

- When Will Ssi Checks Be Deposited For January 2025 Diwali - Mona Sylvia

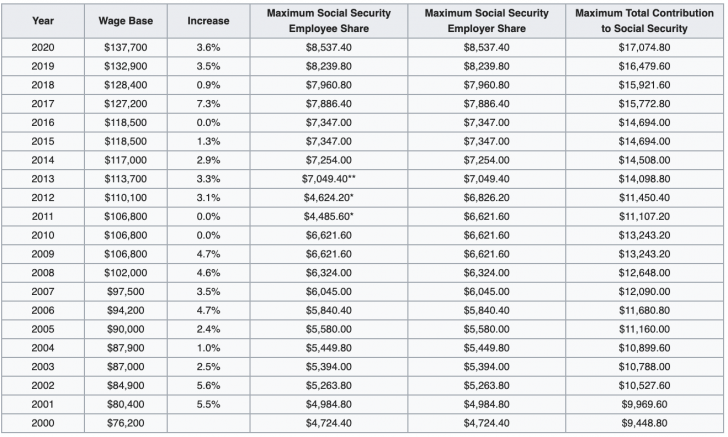

- Income Limit For Maximum Social Security Tax 2021 - Financial Samurai

- What the 2025 Earnings Limit Means for COLA Calculations in Social ...

- WOW! 5 BIG CHANGES Coming To Social Security in 2025 | SSA, SSI, SSDI ...

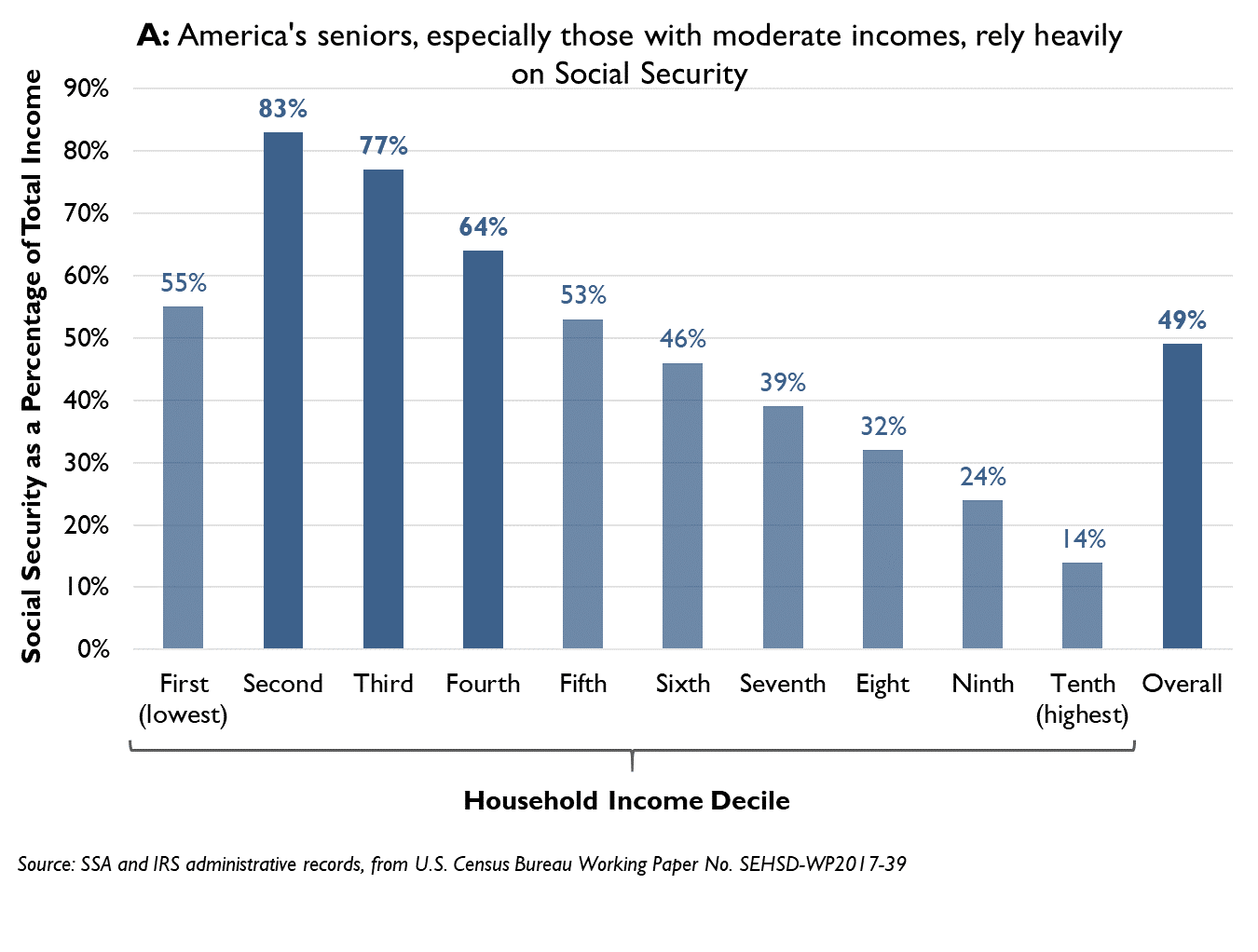

- Understanding the New Social Security Projections in Five Charts ...

- Treasury Inflation-Protected Securities | TIPS: Perfect investment for ...

- Social Security's 2025 COLA Forecast Just Improved. Here's the Latest ...

What is Publication 15-A?

Key Updates in the 2025 Publication 15-A

Employer Tax Obligations

Employers have several tax obligations that they must fulfill, including: Withholding federal income tax: Employers must withhold federal income tax from employee wages and report the amounts withheld on Form W-2. Paying Social Security and Medicare taxes: Employers must pay Social Security and Medicare taxes on behalf of their employees. Reporting employment taxes: Employers must report employment taxes on Form 941 and deposit the taxes on a timely basis.

Accessing the 2025 Publication 15-A

The 2025 Publication 15-A is available on the IRS website in PDF format. Employers can download the guide and use it as a reference to ensure compliance with tax laws and regulations. The publication is also available in print format, and employers can order copies from the IRS website. The PDF 2025 Publication 15-A is an essential resource for employers and tax professionals. The guide provides comprehensive information on employer taxation, including updates on withholding thresholds, tax tables, and fringe benefits. By understanding the key aspects of the publication, employers can ensure compliance with tax laws and regulations, avoiding costly penalties and fines. As the tax landscape continues to evolve, it is crucial for employers to stay informed and up-to-date on the latest developments.For more information on the 2025 Publication 15-A, visit the Internal Revenue Service website. Employers can also consult with tax professionals or seek guidance from the IRS to ensure compliance with tax laws and regulations.